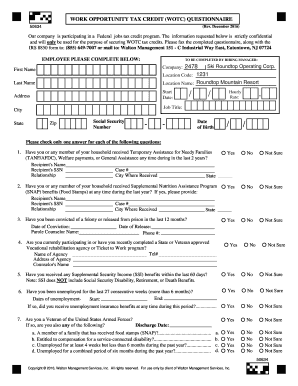

work opportunity tax credit questionnaire form

It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now.

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Completing Your WOTC Questionnaire.

. Below you will find the steps to complete the WOTC both ways. You may complete and submit IRS 8850 and ETA 9061 forms via our electronic WOTC E-WOTC application processing system. Ad IRS-Approved E-File Provider.

Applying For Have You Worked for this Company Before O YES County Driver s License or State ID Number O NO 1. ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees.

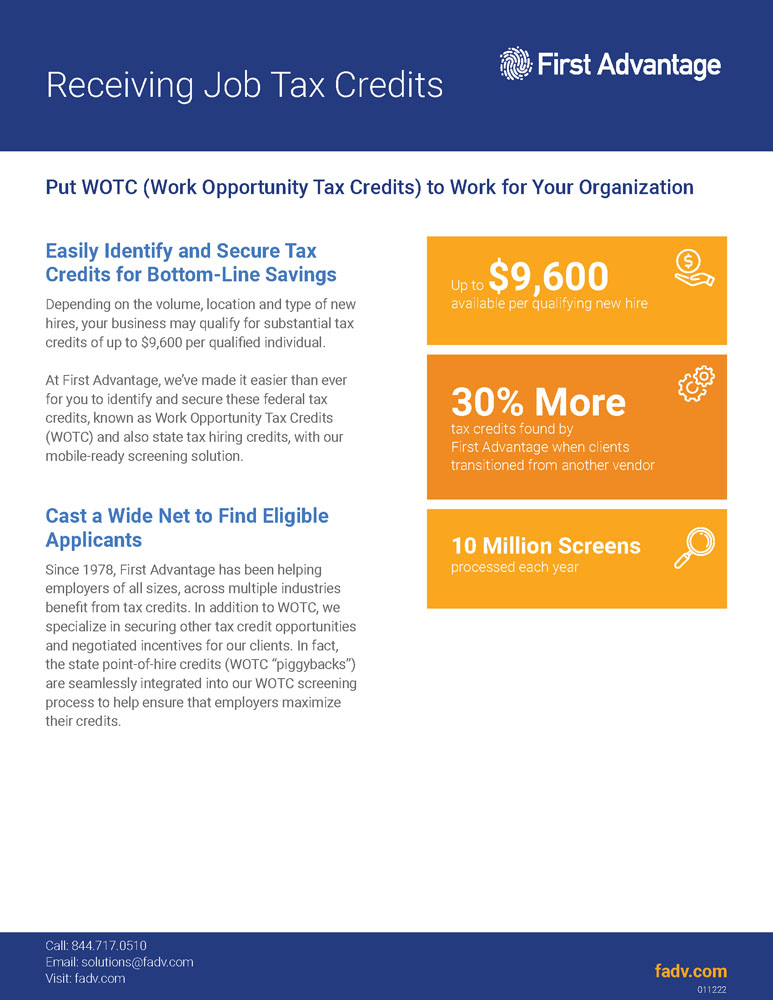

Qualifying Groups For the employer to claim the WOTC for a new hire the employee must be certified as a member of a targeted group by meeting the criteria described in any of the groups listed below. To provide a federal tax credit of up to 9600 to employers who hire these individuals. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions.

EWOTC increases efficiency in processing new applications and decreases the. The Work Opportunity Tax Credit WOTC is a federal program established in 1996 to promote the hiring of individuals from select target groups that face barriers to secure employment. From Simple to Advanced Income Taxes.

The WOTC program not only creates a positive impact on the nations unemployment levels but also affords business owners the incredible opportunity to earn between 2400 and 9600 for each eligible new hire. Over 50 Million Tax Returns Filed. IRS form 8850 must be submitted within 28 days of the employees start date.

Below you will find the steps to complete the WOTC both ways. Employers file Form 5884 to claim the work opportunity credit for qualified 1st- or 2nd-year wages paid to or incurred for. The form may be completed on behalf of the applicant by.

IRS Form 5884 Work Opportunity Tax Credit Use form to report Work Opportunity Tax Credit with tax return. Information about Form 5884 Work Opportunity Credit including recent updates related forms and instructions on how to file. Employers must apply for and receive a certification verifying the new hire is a.

IRS Form 8850 PreScreening Notice and Certification Request for the Work Opportunity Tax Credit. Completing Your WOTC Questionnaire. Wotc Questionnaire 2012-2022 Form.

Within the past 2 years have you or a member of your household received any form of cash or voucher assistance such as Aid. 501c tax exempt organizations use IRS form 5884-C. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now.

Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. Use a wotc form 2012 template to make your document workflow more streamlined. Enter all necessary information in the required fillable areas.

Pick the template in the library. IRS Form 8850 Instructions Instructions for completing IRS Form 8850. Apply for Work Opportunity Tax Credits You can use the online service eWOTC to submit WOTC Request for Certification applications and to view and manage submitted applications.

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. To claim the tax credit when filing your federal business tax return use IRS form 5884.

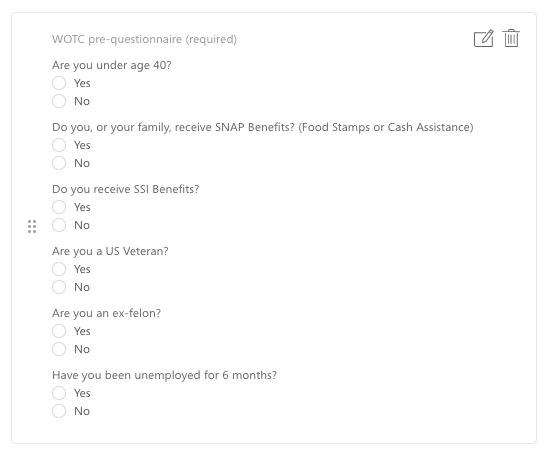

Quickly Prepare and File Your 2021 Tax Return. New hires may be asked to complete the WOTC questionnaire as part of their onboarding paperwork or even as part of the employment application in some cases. Are employees required to fill out WOTC form.

Now creating a Wotc Questionnaire requires at most 5 minutes. Already have an E-WOTC account login here. How to Apply for the WOTC Tax Credit.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Is participating in the WOTC program offered by the government. In the case of the above question the sender did not provide their email address so we were unable to reply directly to them. WOTC Target Groups include.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. To create an E-WOTC account click here.

1 the employer or employer representative the SWA a participating agency or 2 the applicant directly if a minor the parent or guardian must signtheform andsignedBox. Comply with our simple steps to have your Wotc Questionnaire well prepared quickly. Work Opportunity Tax Credit questionnaire.

Page one of Form 8850 is the WOTC questionnaire. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. Help state workforce agencies SWAs determine eligibility for the Work Opportunity Tax Credit WOTC Program. Our state online blanks and complete recommendations eliminate human-prone mistakes.

The Leading Online Publisher of National and State-specific Legal Documents.

Work Opportunity Tax Credit First Advantage

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit What Is Wotc Adp

Completing Your Wotc Questionnaire

21 Printable Review Of Systems Questionnaire Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit What Is Wotc Adp

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Form Pdf Fill Online Printable Fillable Blank Pdffiller

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credits Wotc Walton

Adp Work Opportunity Tax Credit Wotc Avionte Bold